Support the Frank Lloyd Wright Foundation

As a 501(c)3 organization, we are committed to preserving the lasting influence of Frank Lloyd Wright. With help from friends like you, we continue to be a place of imagination, a catalyst for what is possible, a spark for future generations.

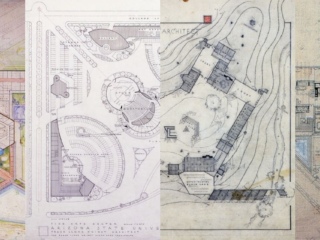

Through our UNESCO World Heritage Site designated properties, Taliesin and Taliesin West, we are a premier destination for arts, architecture and design. We provide our global community with educational opportunities, tours, exhibitions, academic research, and cultural programming.

Your support makes a difference every day!

Make a tax-deductible donation and support the Frank Lloyd Wright Foundation (EIN 86-0197576).

Donate by Phone: 602.800.5410

Give a Gift by Mail: Frank Lloyd Wright Foundation

Attn: Advancement Office

12621 N. Frank Lloyd Wright Blvd.

Scottsdale, AZ 85259

OTHER WAYS TO GIVE

RECURRING GIFTS

Making a recurring gift is a simple way to support the Foundation all year long on a schedule that works for you. Your ongoing generosity directly supports our mission by funding the preservation, conservation, and educational programs that keep our UNESCO World Heritage Sites accessible to everyone.

Planned Giving

Frank Lloyd Wright continues to inspire us to build better and live better, long after his passing. By including the Frank Lloyd Wright Foundation in your planned giving, you too can leave a legacy of support.

STock AND APPRECIATED SECURITIES

Donating stocks, bonds, or mutual funds to the Frank Lloyd Wright Foundation can be a cost-effective way to make a meaningful gift. When you contribute appreciated securities, you may be eligible to claim a charitable deduction based on their fair market value. You can also potentially avoid capital gains tax on the transfer, which many donors find to be a significant financial advantage. To get started, contact your broker about a transfer or beneficiary designation form. Then, simply complete the Stock Donation Form and email it to giving@franklloydwright.org.

RETIREMENT PLAN, IRA CHARITABLE ROLLOVER, OR QUALIFIED CHARITABLE DISTRIBUTION

You can support the Frank Lloyd Wright Foundation with a distribution from your retirement savings during your lifetime or by naming the Foundation as a beneficiary on your account. Qualified charitable distributions (QCDs) made to the Frank Lloyd Wright Foundation may be excluded from your taxable income. They can also help you satisfy your required minimum distribution. To arrange this, you can contact your plan administrator to request a distribution. Have your financial institution complete our QCD Form and email a copy to giving@franklloydwright.org to let us know your donation is on its way.

DONOR-ADVISED FUNDS

A donor-advised fund is often described as a charitable savings account. You transfer cash or other assets to a sponsoring organization, and then you can recommend how much and how often money is granted to the Frank Lloyd Wright Foundation. This offers the flexibility to make a contribution on your own timeline. A key benefit is that you receive a charitable tax deduction when you contribute to the fund. It also allows you to avoid the complexities of managing a private Foundation. To get started, work with your financial advisor to find a sponsoring organization that fits your needs. For more information, contact giving@franklloydwright.org or 602.800.5438 (EIN 86-0197576).

We encourage you to consult with a financial or tax advisor to determine the best approach for your individual situation. Donor-Advised Funds can only be used for gifts with full deductibility – they can not be applied to goods and services, including membership.

DONATE WITH CONFIDENCE

Residents of PA, NY, IL, FL, WA, VA, CO, MD, NJ Charitable Organization Disclosures

Looking for more insight?

Watch this brief video that speaks to Wright’s talents, ambitions, and vision.