What the new tax law means for your charitable giving

Significant changes to the tax code begin on January 1, 2026. These changes will impact how individuals and businesses approach charitable giving to the Frank Lloyd Wright Foundation and other nonprofit organizations.

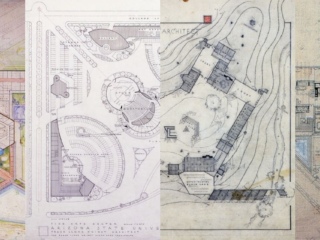

These tax changes coincide with projected reductions in federal funding for the arts in 2026, making your philanthropic support more vital than ever. Your gifts help ensure we can continue to preserve our National Landmarks – Taliesin and Taliesin West. Without you, we can not maintain our aging infrastructure, conserve our vast landscapes, and share our innovative and inspiring stories with the world.

We strongly recommend consulting with a tax or financial advisor to develop a charitable giving strategy aligned with your financial goals and the new tax landscape

As always, we remain grateful for your continued commitment and support.

Key Changes for 2026

New Benefits

- Non-itemizer Deduction: Effective for tax year 2026, taxpayers who don’t itemize can now deduct “above the line” cash donations up to $1,000 (single filers) or $2,000 (married couples filing jointly). (For context: Temporary pandemic-era provisions that once allowed non-itemizers to deduct certain charitable contributions “above the line” expired. In 2024 and 2025, there was/is no way to claim charitable donations for a tax break without itemizing. This change is positive for those who take the standard deduction but still want to reap tax benefits for charitable donations).

- Additional Standard Deduction for Seniors: Individuals 65 and older may claim an additional $6,000 deduction through 2028, on top of the existing senior deduction. Qualified married couples can claim an additional $12,000 deduction.

New Limitations

- Itemizer Threshold: Donors who itemize must give at least 0.5% of their adjusted gross income (AGI) to claim any charitable deduction. This 0.5% “floor” is new in 2026.

- Reduced Benefit for Top Earners: The tax benefit for high-income donors decreases from 37 cents to 35 cents per dollar donated on itemized deductions.

- Corporate Giving Restrictions: Corporations can only deduct charitable contributions exceeding 1% of taxable income, up to a maximum of 10% (with five-year carryforward for excess). Disallowed amounts do not carry forward unless the 10% cap is hit. The 10% ceiling has been in place but the 1% “floor” is new in 2026.

What Remains Unchanged

- Income Tax Brackets: Current tax rates are permanently extended.

- Standard Deduction: The increased standard deduction from the 2017 Tax Act becomes permanent ($15,750 for single filers; $31,500 for married filing jointly in 2025).

- Cash Gift Deduction Limit: You can still deduct cash gifts up to 60% of your AGI. The prior limit was 50%.

- Estate and Gift Tax Exemption: Increases to $15 million per individual and $30 million per married couple starting in 2026.

Strategic Giving Considerations

For 2025 (Before Changes Take Effect)

- Consider accelerating significant charitable contributions into 2025 to maximize deductions under current rules.

- High-income donors may especially benefit from front-loading donations before the new caps and reduced benefits apply.

For 2026 and Beyond

- Non-itemizers should take advantage of the new deduction opportunity.

- Consider “blended giving” (combining cash and non-cash assets) to maximize tax benefits.

- If you’re 70½ or older, direct gifts from your IRA remain advantageous.

- Estates under the exemption threshold should focus on current giving for immediate tax benefits.